All Categories

Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance policy policy that covers the insurance policy holder for a details amount of time, which is known as the term. The term sizes differ according to what the individual chooses. Terms typically vary from 10 to 30 years and increase in 5-year increments, supplying degree term insurance.

They normally supply a quantity of insurance coverage for much less than irreversible kinds of life insurance coverage. Like any plan, term life insurance policy has advantages and downsides relying on what will certainly work best for you. The advantages of term life consist of price and the capability to tailor your term size and protection amount based upon your needs.

Depending on the sort of plan, term life can offer taken care of premiums for the entire term or life insurance coverage on degree terms. The fatality advantages can be repaired. Since it's an affordable life insurance policy product and the settlements can remain the exact same, term life insurance policies are preferred with young people just beginning, households and individuals that desire defense for a particular time period.

*** Rates mirror plans in the Preferred Plus Price Course issues by American General 5 Stars My representative was extremely experienced and practical in the process. July 13, 2023 5 Stars I was pleased that all my demands were met immediately and professionally by all the reps I talked to.

What Are the Terms in Term Life Insurance?

All documents was digitally completed with accessibility to downloading and install for individual data upkeep. June 19, 2023 The endorsements/testimonials presented need to not be construed as a recommendation to buy, or an indicator of the value of any item or service. The testimonials are real Corebridge Direct clients who are not affiliated with Corebridge Direct and were not offered settlement.

There are numerous sorts of term life insurance policy policies. As opposed to covering you for your entire life-span like whole life or universal life policies, term life insurance policy only covers you for an assigned time period. Plan terms generally vary from 10 to three decades, although shorter and much longer terms may be available.

Most typically, the policy ends. If you desire to maintain protection, a life insurer may use you the option to renew the policy for another term. Or, your insurance firm may allow you to transform your term plan to a long-term policy. If you included a return of premium cyclist to your plan, you would certainly receive some or every one of the cash you paid in premiums if you have outlasted your term.

Level term life insurance may be the very best option for those that desire insurance coverage for a set amount of time and desire their costs to remain secure over the term. This may relate to customers worried about the price of life insurance policy and those that do not want to transform their survivor benefit.

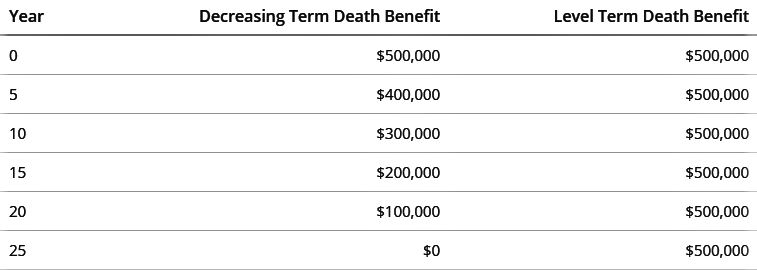

That is due to the fact that term policies are not assured to pay out, while irreversible policies are, provided all costs are paid., where the fatality advantage lowers over time.

On the other side, you may be able to protect a less expensive life insurance policy price if you open up the policy when you're more youthful. Comparable to sophisticated age, inadequate health can also make you a riskier (and extra costly) candidate for life insurance policy. Nonetheless, if the problem is well-managed, you may still have the ability to locate budget friendly insurance coverage.

Why You Should Consider 20-year Level Term Life Insurance

Wellness and age are usually much more impactful premium factors than sex. Risky hobbies, like diving and skydiving, may lead you to pay even more forever insurance. In a similar way, high-risk jobs, like window cleansing or tree cutting, might also increase your expense of life insurance policy. The ideal life insurance coverage business and plan will certainly depend on the individual looking, their individual rating aspects and what they require from their plan.

The initial step is to identify what you require the policy for and what your budget plan is. Some business use on-line quoting for life insurance coverage, but lots of require you to speak to a representative over the phone or in person.

1Term life insurance coverage supplies short-term security for an essential period of time and is generally cheaper than irreversible life insurance policy. 2Term conversion standards and constraints, such as timing, may use; for instance, there might be a ten-year conversion opportunity for some items and a five-year conversion privilege for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Choice in New York. 4Not offered in every state. There is a cost to exercise this motorcyclist. Products and riders are available in approved territories and names and attributes might differ. 5Dividends are not assured. Not all getting involved plan proprietors are eligible for dividends. For select motorcyclists, the condition relates to the insured.

Our term life choices consist of 10, 15, 20, 25, 30, 35, and 40-year plans. One of the most preferred type is level term, meaning your payment (costs) and payment (fatality advantage) stays degree, or the same, until completion of the term period. Annual renewable term life insurance. This is one of the most straightforward of life insurance policy alternatives and needs very little maintenance for plan proprietors

You could give 50% to your spouse and divided the remainder among your adult children, a moms and dad, a friend, or even a charity. * In some circumstances the survivor benefit might not be tax-free, find out when life insurance is taxable.

The Essentials: What is Life Insurance Level Term?

There is no payout if the plan expires before your fatality or you live beyond the plan term. You might have the ability to restore a term plan at expiration, yet the costs will certainly be recalculated based on your age at the time of revival. Term life insurance policy is generally the least expensive life insurance policy available due to the fact that it uses a survivor benefit for a limited time and does not have a money worth component like long-term insurance policy - What is a level term life insurance policy.

At age 50, the premium would certainly rise to $67 a month. Term Life Insurance Policy Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and ladies in outstanding wellness. On the other hand, right here's a check out rates for a $100,000 whole life plan (which is a sort of irreversible policy, implying it lasts your lifetime and includes cash money value).

Passion prices, the financials of the insurance business, and state guidelines can additionally influence costs. When you take into consideration the quantity of coverage you can obtain for your costs dollars, term life insurance policy tends to be the least pricey life insurance.

Latest Posts

Final Expense Insurance For Cremation

Life Insurance Quote Online Instant

Pros And Cons Of Final Expense Insurance