All Categories

Featured

Table of Contents

Keeping all of these phrases and insurance coverage types right can be a headache. The following table puts them side-by-side so you can swiftly separate amongst them if you get confused. One more insurance protection type that can pay off your home loan if you pass away is a typical life insurance policy policy

An is in place for a set variety of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to die throughout that term. An offers insurance coverage for your whole life expectancy and pays when you pass away. As opposed to paying your home mortgage lending institution straight the means home loan protection insurance coverage does, conventional life insurance policy plans most likely to the recipients you select, who can then choose to pay off the home loan.

One typical general rule is to go for a life insurance policy policy that will certainly pay out up to 10 times the policyholder's wage quantity. You could pick to utilize something like the DIME technique, which includes a household's financial obligation, earnings, home mortgage and education and learning expenses to calculate exactly how much life insurance is needed.

It's additionally worth keeping in mind that there are age-related restrictions and thresholds imposed by almost all insurance providers, that typically will not offer older purchasers as lots of choices, will certainly charge them much more or might refute them outright.

Here's exactly how home loan security insurance coverage measures up versus common life insurance policy. If you're able to qualify for term life insurance, you must avoid mortgage defense insurance (MPI).

In those situations, MPI can offer excellent comfort. Simply make sure to comparison-shop and read all of the fine print before registering for any plan. Every home mortgage protection option will have countless rules, laws, advantage options and downsides that require to be weighed very carefully versus your exact circumstance (housing loan protection plan).

Globe Life Home Mortgage Group

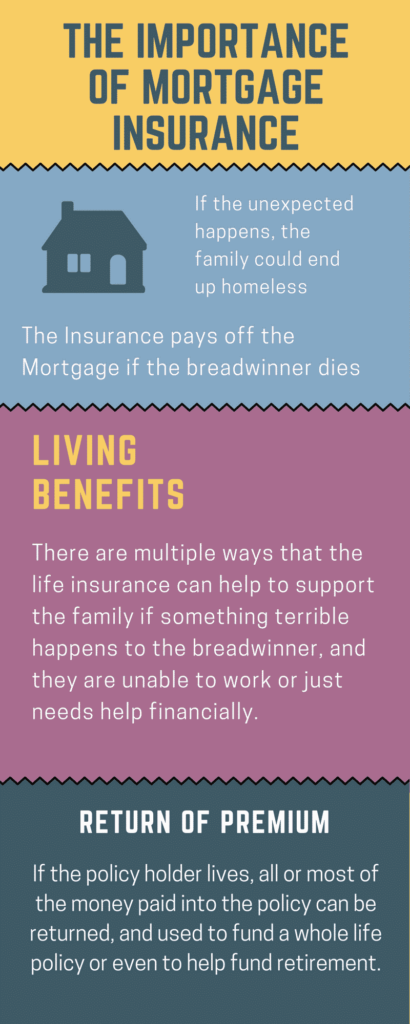

A life insurance coverage plan can help pay off your home's mortgage if you were to pass away. It's one of lots of manner ins which life insurance policy might aid protect your liked ones and their financial future. One of the very best methods to factor your mortgage into your life insurance requirement is to speak with your insurance coverage agent.

As opposed to a one-size-fits-all life insurance plan, American Household Life Insurer uses plans that can be created particularly to satisfy your family members's needs. Here are a few of your alternatives: A term life insurance plan. payment protection insurance definition is active for a particular quantity of time and commonly supplies a bigger quantity of insurance coverage at a lower cost than a permanent policy

Rather than just covering a set number of years, it can cover you for your whole life. It additionally has living advantages, such as cash money value buildup. * American Family Life Insurance Company offers different life insurance policy plans.

They may likewise be able to aid you find spaces in your life insurance policy coverage or new means to save on your other insurance coverage policies. A life insurance policy recipient can pick to utilize the death benefit for anything.

Life insurance is one means of assisting your family in paying off a mortgage if you were to die prior to the home loan is completely paid back. No. Life insurance policy is not compulsory, but it can be a vital part helpful make sure your enjoyed ones are monetarily protected. Life insurance coverage proceeds might be utilized to help pay off a home mortgage, however it is not the like mortgage insurance that you could be needed to have as a problem of a finance.

Term Insurance For Home Loan Protection

Life insurance policy may help guarantee your home remains in your family by giving a survivor benefit that may assist pay down a home mortgage or make essential acquisitions if you were to die. Get in touch with your American Family members Insurance policy agent to review which life insurance coverage policy best fits your demands. This is a short description of protection and goes through policy and/or cyclist terms, which may vary by state.

Words lifetime, long-lasting and irreversible undergo plan conditions. * Any type of finances taken from your life insurance policy will certainly accrue passion. how to sell mortgage protection insurance. Any outstanding loan balance (finance plus passion) will be subtracted from the survivor benefit at the time of claim or from the cash money value at the time of abandonment

Discounts do not apply to the life policy. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage defense insurance coverage (MPI) is a various type of safeguard that could be valuable if you're not able to settle your home mortgage. Mortgage protection insurance coverage is an insurance policy that pays off the remainder of your mortgage if you pass away or if you end up being impaired and can't work.

Both PMI and MIP are called for insurance protections. The quantity you'll pay for home mortgage protection insurance policy depends on a variety of elements, including the insurer and the existing equilibrium of your mortgage.

Still, there are benefits and drawbacks: Most MPI policies are released on a "guaranteed approval" basis. That can be useful if you have a health and wellness problem and pay high rates for life insurance policy or battle to get protection. mortgage protection vs life insurance. An MPI plan can provide you and your family with a sense of safety and security

Mortgage Life And Disability Insurance Canada

It can likewise be valuable for individuals who do not get approved for or can not manage a conventional life insurance coverage policy. You can select whether you require home loan defense insurance and for for how long you need it. The terms usually range from 10 to thirty years. You may desire your home loan security insurance term to be enclose size to the length of time you have left to repay your mortgage You can cancel a home loan security insurance coverage.

Latest Posts

Final Expense Insurance For Cremation

Life Insurance Quote Online Instant

Pros And Cons Of Final Expense Insurance