All Categories

Featured

Table of Contents

Life insurance coverage covers the guaranteed individual's life. If you pass away while your plan is energetic, your recipients can use the payout to cover whatever they select clinical expenses, funeral costs, education, loans, everyday prices, and also savings.

Depending on the condition, it might impact the plan kind, price, and insurance coverage quantity an insurance provider provides you. It is essential to be truthful and transparent in your life insurance policy application and throughout your life insurance policy clinical examination falling short to divulge requested details can be thought about life insurance scams. Life insurance policy policies can be categorized right into three major teams, based on exactly how they work:.

What is the best Income Protection option?

OGB uses 2 fully-insured life insurance policy plans for employees and retirees with. The state pays half of the life insurance policy costs for covered staff members and senior citizens. The 2 strategies of life insurance offered, along with the equivalent quantities of dependent life insurance supplied under each strategy, are kept in mind listed below.

Term Life insurance coverage is a pure transfer of risk in exchange for the payment of premium. Prudential, and prior carriers, have actually been supplying coverage and assuming threat for the payment of costs. In case a covered person were to pass, Prudential would recognize their obligation/contract and pay the benefit.

Strategy members currently enrolled who wish to add reliant life protection for a spouse can do so by giving proof of insurability. Eligible reliant youngsters can be included without offering evidence of insurability to the insurance company. Employee pays one hundred percent of dependent life premiums. Standard and Standard And Also Supplemental Plans Full-Time Employees Qualified Retirees If retired, insurance coverage for AD&D immediately ends on January 1 following the covered individual's 70th birthday celebration.

2018 Prudential Financial, Inc. and its associated entities. Prudential, the Prudential logo design, the Rock symbol, and Bring Your Difficulties are solution marks of Prudential Financial, Inc. and its associated entities, signed up in lots of jurisdictions worldwide.

Who are the cheapest Long Term Care providers?

The rate structure enables workers, spouses and residential companions to pay for their insurance based upon their ages and chosen protection quantity(s). The optimum assured issuance amount available within 60 days of your hire date, without proof of insurability is 5 times your base yearly wage or $1,000,000, whichever is much less.

While every effort has been made to make certain the accuracy of this Recap, in the occasion of any type of discrepancy the Recap Plan Summary and Plan File will prevail.

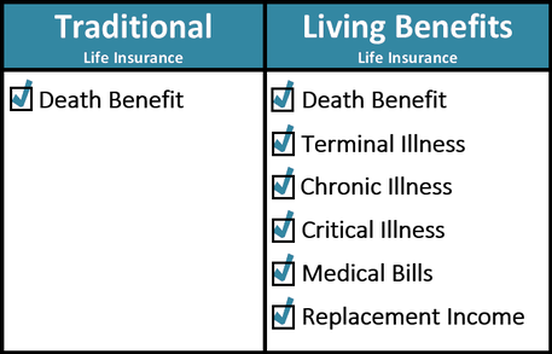

You'll want to make sure you have options available simply in instance. Luckily for you, lots of life insurance coverage policies with living benefits can offer you with financial help while you're active, when you need it the many.

On the various other hand, there are irreversible life insurance policy plans. These policies are typically extra expensive and you'll likely need to go through medical checkups, however the advantages that come with it are component of the reason for this. You can add living advantages to these strategies, and they have money worth development potential with time, suggesting you may have a couple of different alternatives to make use of in situation you require funding while you're still to life. Cash value plans.

Why is Long Term Care important?

These policies may permit you to add on certain living benefits while additionally permitting your plan to accumulate money value that you can take out and use when you require to. resembles entire life insurance policy in that it's a long-term life insurance policy policy that means you can be covered for the remainder of your life while taking pleasure in a plan with living advantages.

When you pay your costs for these policies, part of the payment is diverted to the cash value. This money worth can expand at either a repaired or variable price as time advances depending upon the kind of plan you have. It's this quantity that you may have the ability to gain access to in times of requirement while you live.

The downside to using a withdrawal is that it might increase your premium or reduced your death benefit. Surrendering a policy essentially suggests you have actually terminated your policy outright, and it immediately gives you the money value that had built up, much less any type of surrender charges and outstanding policy costs.

Using money worth to pay costs is essentially just what it sounds like. Depending on the kind of policy, you can utilize the cash money worth that you have accrued with your life insurance coverage plan to pay a section or all your costs.

Legacy Planning

The terms and quantity offered will certainly be defined in the plan. Any living advantage paid from the survivor benefit will lower the amount payable to your beneficiary (Trust planning). This payment is meant to assist supply you with comfort for completion of your life along with help with medical expenditures

Vital disease cyclist guarantees that benefits are paid directly to you to spend for therapy solutions for the illness defined in your policy agreement. Long-lasting care riders are implemented to cover the price of in-home care or retirement home costs as you get older. A life negotiation is the procedure where you sell a life insurance policy policy to a 3rd party for a swelling amount repayment.

What are the benefits of Whole Life Insurance?

That depends. If you remain in an irreversible life insurance policy plan, after that you have the ability to take out cash money while you live through loans, withdrawals, or surrendering the plan. Before deciding to take advantage of your life insurance coverage plan for cash, get in touch with an insurance policy representative or representative to identify exactly how it will influence your beneficiaries after your fatality.

All life insurance policy plans have one point in common they're made to pay money to "called beneficiaries" when you pass away. Life insurance coverage policies can be taken out by partners or any person that is able to confirm they have an insurable rate of interest in the individual.

What happens if I don’t have Beneficiaries?

The plan pays money to the called recipients if the insured passes away during the term. Term life insurance coverage is planned to provide lower-cost coverage for a certain duration, like a 10 years or 20-year duration. Term life policies might consist of a stipulation that enables protection to continue (renew) at the end of the term, also if your health standing has altered.

Ask what the costs will be prior to you renew. If the policy is non-renewable you will certainly need to use for protection at the end of the term.

Latest Posts

Final Expense Insurance For Cremation

Life Insurance Quote Online Instant

Pros And Cons Of Final Expense Insurance