All Categories

Featured

Table of Contents

Life insurance policy offers five financial benefits for you and your household. The main benefit of including life insurance to your financial strategy is that if you die, your successors obtain a swelling sum, tax-free payout from the plan. They can utilize this money to pay your final costs and to change your revenue.

Some policies pay if you establish a chronic/terminal illness and some give cost savings you can use to sustain your retired life. In this article, discover the numerous advantages of life insurance policy and why it might be an excellent idea to buy it. Life insurance offers advantages while you're still alive and when you pass away.

What should I know before getting Wealth Transfer Plans?

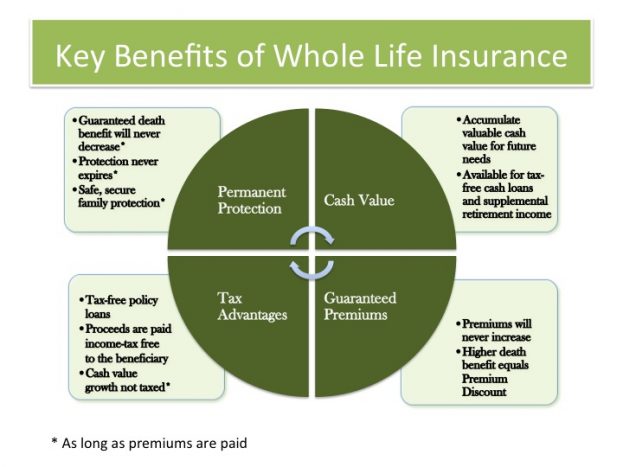

Life insurance coverage payouts typically are income-tax cost-free. Some irreversible life insurance coverage plans build money worth, which is money you can take out while still alive.

If you have a plan (or plans) of that size, the individuals that depend on your revenue will certainly still have money to cover their ongoing living expenditures. Beneficiaries can use policy benefits to cover critical daily costs like rental fee or home loan settlements, utility expenses, and grocery stores. Typical annual expenses for households in 2022 were $72,967, according to the Bureau of Labor Stats.

Life insurance policy payouts aren't thought about earnings for tax objectives, and your beneficiaries don't have to report the money when they submit their tax returns. Depending on your state's legislations, life insurance policy advantages might be made use of to counter some or all of owed estate tax obligations.

Growth is not impacted by market problems, enabling the funds to gather at a stable price in time. In addition, the money value of whole life insurance policy grows tax-deferred. This indicates there are no income taxes accrued on the cash value (or its growth) till it is withdrawn. As the money value accumulates with time, you can utilize it to cover expenditures, such as purchasing an automobile or making a deposit on a home.

Who provides the best Income Protection?

If you determine to obtain versus your money value, the lending is not subject to income tax obligation as long as the plan is not surrendered. The insurer, however, will bill interest on the funding quantity up until you pay it back. Insurance provider have varying rates of interest on these fundings.

8 out of 10 Millennials overestimated the price of life insurance policy in a 2022 research. In reality, the ordinary price is more detailed to $200 a year. If you assume purchasing life insurance policy may be a clever monetary action for you and your household, consider consulting with a financial consultant to adopt it right into your financial plan.

What is included in Term Life coverage?

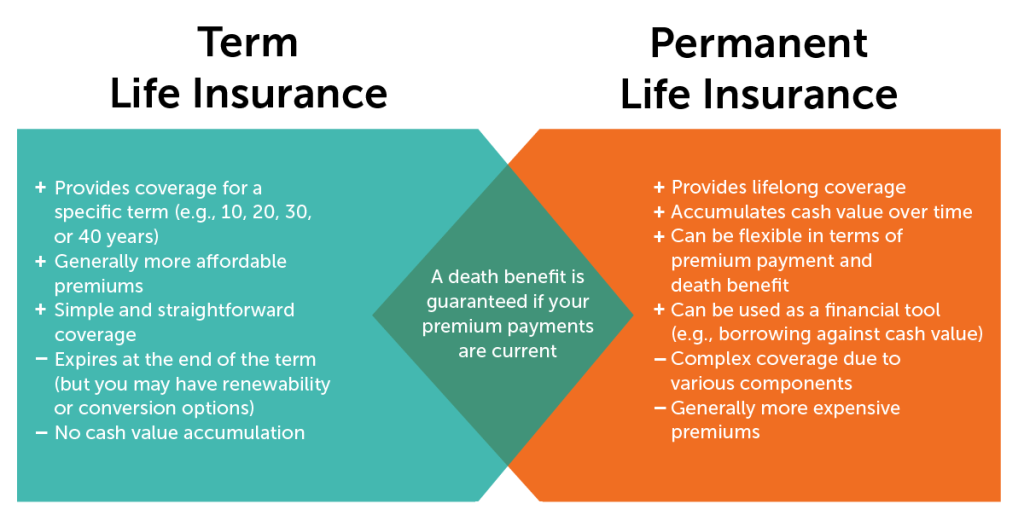

The 5 major kinds of life insurance coverage are term life, entire life, global life, variable life, and last expenditure insurance coverage, also referred to as funeral insurance coverage. Each kind has various functions and benefits. As an example, term is much more cost effective yet has an expiry date. Entire life begins costing extra, but can last your whole life if you maintain paying the premiums.

It can repay your financial debts and medical bills. Life insurance coverage can likewise cover your home mortgage and offer money for your household to keep paying their costs. If you have family members depending on your income, you likely require life insurance policy to sustain them after you pass away. Stay-at-home moms and dads and entrepreneur likewise typically need life insurance policy.

Lesser quantities are available in increments of $10,000. Under this strategy, the elected protection takes result two years after enrollment as long as costs are paid during the two-year period.

Protection can be extended for up to 2 years if the Servicemember is completely handicapped at separation. SGLI insurance coverage is automatic for most active responsibility Servicemembers, Ready Get and National Guard members arranged to perform at least 12 durations of inactive training per year, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health and wellness Solution, cadets and midshipmen of the United state

VMLI is available to Readily available who received a Obtained Adapted Particularly Adjusted (Give), have title to the home, and have a mortgage on the home. All Servicemembers with full time insurance coverage need to utilize the SGLI Online Enrollment System (SOES) to mark beneficiaries, or minimize, decline or restore SGLI coverage.

All Servicemembers need to use SOES to decrease, reduce, or bring back FSGLI protection.

Who are the cheapest Term Life providers?

Policy advantages are decreased by any type of outstanding loan or car loan interest and/or withdrawals. Returns, if any, are impacted by plan finances and financing passion. Withdrawals above the expense basis might lead to taxed normal revenue. If the policy lapses, or is given up, any kind of exceptional loans taken into consideration gain in the plan may undergo common earnings tax obligations.

If the policy proprietor is under 59, any taxable withdrawal may likewise be subject to a 10% federal tax obligation penalty. All entire life insurance coverage policy warranties are subject to the prompt settlement of all needed premiums and the claims paying ability of the issuing insurance business.

The money surrender worth, finance value and fatality earnings payable will certainly be minimized by any kind of lien exceptional due to the repayment of an accelerated benefit under this rider. The accelerated advantages in the first year mirror reduction of a single $250 management cost, indexed at an inflation rate of 3% per year to the rate of acceleration.

A Waiver of Premium motorcyclist waives the responsibility for the insurance holder to pay further premiums should she or he become entirely disabled continually for at the very least 6 months. This rider will sustain an extra price. See policy contract for extra details and demands.

Where can I find Protection Plans?

Find out more concerning when to obtain life insurance coverage. A 10-year term life insurance policy from eFinancial prices $2025 monthly for a healthy and balanced adult that's 2040 years old. * Term life insurance policy is much more cost effective than permanent life insurance policy, and female clients normally obtain a reduced price than male customers of the same age and wellness status.

Latest Posts

Life Insurance Quote Online Instant

Pros And Cons Of Final Expense Insurance

Final Care Solutions