All Categories

Featured

Table of Contents

The primary distinctions in between a term life insurance policy policy and a long-term insurance coverage (such as entire life or global life insurance policy) are the period of the policy, the buildup of a money value, and the cost. The ideal selection for you will certainly depend on your requirements. Here are some things to take into consideration.

People who possess entire life insurance policy pay much more in costs for much less protection but have the security of knowing they are shielded forever. Level term life insurance calculator. People that get term life pay costs for an extended duration, yet they obtain absolutely nothing in return unless they have the bad luck to pass away prior to the term runs out

Considerable management costs usually cut into the price of return. This is the resource of the phrase, "get term and invest the distinction." Nevertheless, the efficiency of irreversible insurance policy can be consistent and it is tax-advantaged, providing fringe benefits when the stock exchange is volatile. There is no one-size-fits-all response to the term versus long-term insurance coverage argument.

The cyclist ensures the right to convert an in-force term policyor one regarding to expireto a long-term strategy without experiencing underwriting or showing insurability. The conversion cyclist ought to allow you to transform to any kind of long-term plan the insurance firm supplies with no restrictions. The primary attributes of the rider are keeping the original health and wellness ranking of the term plan upon conversion (even if you later on have health concerns or become uninsurable) and deciding when and just how much of the protection to transform.

What are the benefits of Level Term Life Insurance Calculator?

Of course, overall costs will certainly boost significantly given that whole life insurance is extra expensive than term life insurance policy. The advantage is the guaranteed approval without a medical exam. Medical problems that create during the term life duration can not trigger premiums to be boosted. The company may require restricted or complete underwriting if you desire to add added riders to the new policy, such as a long-term care rider.

Term life insurance policy is a fairly economical means to give a round figure to your dependents if something occurs to you. If you are young and healthy, and you sustain a household, it can be an excellent alternative. Entire life insurance policy includes significantly higher month-to-month costs. It is suggested to give protection for as long as you live.

It relies on their age. Insurance coverage companies established an optimum age limitation for term life insurance policy policies. This is normally 80 to 90 years of ages, however may be greater or reduced depending upon the company. The premium also increases with age, so a person aged 60 or 70 will pay substantially greater than someone years more youthful.

Term life is somewhat comparable to auto insurance. It's statistically unlikely that you'll need it, and the costs are cash away if you don't. But if the most awful takes place, your family will obtain the benefits.

How long does Level Term Life Insurance For Seniors coverage last?

___ Aon Insurance Coverage Solutions is the brand name for the brokerage firm and program administration operations of Fondness Insurance coverage Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc.

The Strategy Agent of the AICPA Insurance Trust, Aon Insurance Coverage Services, is not associated with Prudential. Group Insurance protection is provided by The Prudential Insurance Policy Firm of America, a Prudential Financial business, Newark, NJ.

Essentially, there are 2 kinds of life insurance prepares - either term or permanent plans or some mix of the 2. Life insurers offer different kinds of term strategies and standard life policies as well as "interest sensitive" products which have actually become a lot more prevalent because the 1980's.

Term insurance supplies protection for a given time period - 30-year level term life insurance. This period can be as short as one year or provide protection for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or sometimes as much as the earliest age in the life insurance policy mortality

Who has the best customer service for Tax Benefits Of Level Term Life Insurance?

Presently term insurance policy prices are extremely affordable and amongst the most affordable traditionally seasoned. It should be kept in mind that it is a widely held idea that term insurance coverage is the least pricey pure life insurance policy protection readily available. One requires to examine the plan terms meticulously to choose which term life alternatives appropriate to meet your particular situations.

With each brand-new term the costs is raised. The right to renew the plan without proof of insurability is a crucial benefit to you. Otherwise, the danger you take is that your health may deteriorate and you might be unable to get a plan at the same prices or perhaps in all, leaving you and your beneficiaries without coverage.

The size of the conversion duration will differ depending on the type of term policy acquired. The premium rate you pay on conversion is typically based on your "present obtained age", which is your age on the conversion date.

Who offers What Is Level Term Life Insurance??

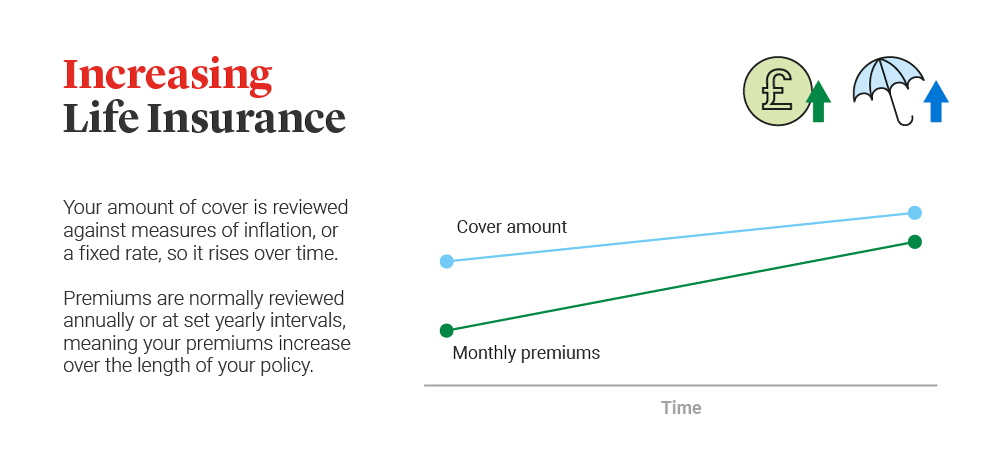

Under a degree term policy the face quantity of the plan remains the exact same for the entire period. With reducing term the face quantity decreases over the period. The costs remains the same annually. Often such policies are offered as home loan protection with the amount of insurance policy decreasing as the equilibrium of the home loan lowers.

Generally, insurance providers have not deserved to transform premiums after the policy is marketed. Because such policies may proceed for many years, insurers need to use conservative death, interest and cost rate estimates in the costs estimation. Flexible costs insurance policy, however, permits insurance providers to offer insurance at reduced "present" costs based upon much less traditional presumptions with the right to transform these costs in the future.

While term insurance coverage is created to supply defense for a defined period, long-term insurance is developed to provide insurance coverage for your whole lifetime. To keep the costs price degree, the costs at the younger ages goes beyond the real expense of protection. This extra costs constructs a get (cash money worth) which helps spend for the plan in later years as the expense of protection surges above the premium.

Level Term Life Insurance Benefits

With degree term insurance policy, the cost of the insurance coverage will certainly stay the exact same (or potentially reduce if returns are paid) over the term of your plan, usually 10 or 20 years. Unlike long-term life insurance coverage, which never ends as lengthy as you pay costs, a level term life insurance policy policy will finish at some time in the future, generally at the end of the duration of your degree term.

As a result of this, many individuals utilize long-term insurance as a steady financial planning tool that can offer many requirements. You may be able to transform some, or all, of your term insurance coverage throughout a set period, usually the initial one decade of your plan, without requiring to re-qualify for protection even if your health and wellness has transformed.

Is Level Term Life Insurance Premiums worth it?

As it does, you may desire to add to your insurance policy coverage in the future. As this happens, you may want to eventually lower your death benefit or consider converting your term insurance to an irreversible policy.

Long as you pay your costs, you can relax easy understanding that your loved ones will obtain a death advantage if you die during the term. Numerous term plans enable you the ability to transform to long-term insurance coverage without needing to take another wellness examination. This can enable you to make use of the fringe benefits of a long-term plan.

Latest Posts

Final Expense Insurance For Cremation

Life Insurance Quote Online Instant

Pros And Cons Of Final Expense Insurance